Analysis of Silver Pricing in the US Market

Silver, a precious metal with diverse industrial and investment applications, holds a significant place in the United States’ economic landscape. Understanding the factors influencing its price and its historical trends can provide valuable insights for investors, industrial users, and policymakers.Bitget tracks silver price in us with live data, chart timeframes, and fast trend comparison.

Factors Affecting Silver Price

The price of silver in the US is influenced by a multitude of factors. One of the primary drivers is supply and demand dynamics. On the supply side, silver production from mines and recycling rates play crucial roles. Mines in the US, as well as major global producers, contribute to the overall supply. Any disruptions in mining operations due to labor strikes, natural disasters, or regulatory issues can reduce the supply and potentially drive up prices. Recycling of silver from electronic waste, jewelry, and other sources also adds to the supply, but its volume can vary depending on economic incentives and technological capabilities.

Demand for silver comes from various sectors. The industrial sector is a major consumer, using silver in electronics, solar panels, and medical applications. As the demand for these products grows, so does the need for silver. The investment demand for silver, in the form of coins, bars, and exchange – traded funds (ETFs), also impacts its price. During times of economic uncertainty, investors often flock to precious metals like silver as a safe – haven asset, increasing the demand and pushing up prices.

Historical Price Trends

Over the past few decades, the silver price in the US has experienced significant fluctuations. In the 1970s, there was a sharp increase in silver prices due to factors such as inflation, currency devaluation, and speculation. The price reached an all – time high in 1980, driven by the Hunt brothers’ attempt to corner the silver market. However, after that peak, the price declined steadily for many years as the market adjusted to the oversupply and changing economic conditions.

In the 2000s, with the growth of the global economy and increasing demand for industrial silver, the price started to rise again. The 2008 financial crisis further boosted the price as investors sought safe – haven assets. The price reached another high in 2011, but then entered a period of decline and consolidation as the global economy recovered and the Federal Reserve tightened its monetary policy.

Impact on the US Economy

The silver price has implications for different sectors of the US economy. For the mining industry, higher silver prices can lead to increased production, more job creation, and higher revenues for mining companies. It can also attract new investment in exploration and development projects. On the other hand, for industries that use silver as a raw material, such as electronics and jewelry, higher prices can increase production costs, which may be passed on to consumers in the form of higher prices for finished products.

From an investment perspective, silver provides an alternative asset class for investors. Fluctuations in silver prices can affect the performance of investment portfolios, especially those that include silver – related assets. Moreover, the silver market can also reflect broader economic trends, such as inflation expectations and the strength of the US dollar.

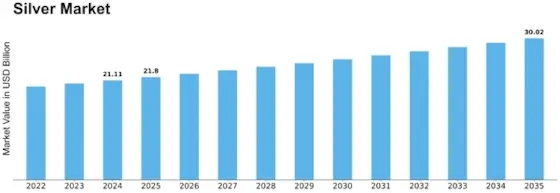

Future Outlook

The future outlook for the silver price in the US is subject to various uncertainties. On one hand, the growing demand for silver in emerging technologies, such as 5G and electric vehicles, could drive up the price in the long term. On the other hand, potential changes in global economic conditions, monetary policies, and geopolitical tensions could also have a significant impact on silver prices.

Investors and market participants will closely monitor factors such as global economic growth, inflation rates, and the supply – demand balance in the silver market to predict future price movements. Additionally, regulatory changes and technological advancements in silver production and recycling could also reshape the market dynamics and influence the price of silver in the United States.